The Financial Sector (Climate-related Disclosure and Other Matters) Amendment Bill (Bill) passed its first reading on 15 April 2021, and we are due to hear back from the Select Committee in the next few weeks. The Bill will amend the Financial Markets Conduct Act 2013 (FMCA) by creating a new Part 7A, "Climate-related disclosures for certain FMC reporting entities with higher levels of public accountability".

In effect, large financial institutions (ie banks, credit unions, building societies and insurers) and publicly listed entities will be defined as "climate reporting entities" (Entities) and will be required to prepare "climate statements". In many ways, this requirement is similar to those set out in the Companies Act 1993 and the FMCA for certain companies and other entities to prepare financial statements for the purpose of informing their key stakeholders.

The Bill requires climate statements to be prepared in accordance with "applicable climate standards". The Government has indicated that these applicable climate standards will be created by the External Reporting Board and will be based on the recommendations of the Task Force on Climate-related Financial Disclosures (TCFD), which have become widely adopted globally as best practice in the area of climate disclosure.

This article explores what the Bill might mean for the future direction of climate-related financial regulation – in particular, whether this signals the first step in the implementation of prudential "climate stress tests" and other climate related regulation, or whether this is the end of the line.

What must a climate statement contain?

The cornerstone of the TCFD recommendations is the use of forward-looking scenario analysis. While such analysis can be complex and somewhat speculative, it is an established method for developing strategic plans that are flexible and robust enough to suit a range of future states. Many financial institutions that will become subject to these new disclosure requirements will already be familiar with the use of forward-looking scenarios, as they are already the subject of such supervisory stress tests undertaken by the Reserve Bank of New Zealand (RBNZ), as part of its role as the prudential regulator.

Designing climate scenarios

Scenario analysis would effectively involve an Entity designing a number of hypothetical climate scenarios, each based on either one or many severe, but plausible, climate-related external events. In designing these events, Entities should consider each of the risks and opportunities identified in the TCFD recommendations and think about which risks and opportunities seem most likely to impact its activities.

Scenarios should not be exclusively favourable, and should also be based on events that, in the Entity's assessment, could actually occur and have an impact on their business. For example, it is not useful to design a scenario based on a bushfire in California if the Entity has very limited assets, business activities, customers or suppliers in California.

Scenario pathways

Climate scenarios should be designed based on risks and opportunities presented in a number of "scenario pathways". Examples of scenario pathways include:

- A pathway where the world is successful in limiting warming to under two degrees – note that the TCFD strongly recommends this pathway be used (and therefore it is possible that such a scenario could become mandatory under applicable climate standards)

- A pathway consistent with New Zealand's National Defined Contribution (NDC) – New Zealand's NDC is currently consistent with 2-3 degrees of warming by 2100

- A business-as-usual pathway – this pathway would lead to at least 3 degrees of warming by 2100, and

- Other pathways based on an Entity's understanding of expected future market trends in its industry and the impact of those market trends on the speed of the transition to a zero emissions economy.

Analysing the impact of climate scenarios

Once the climate scenarios have been designed, Entities should assess the impact that those scenarios are expected to have (both at the enterprise and region-specific level) on things like asset valuations, increased liabilities to manage an event, changes to revenue, cashflow constraints, business continuity capability, access to finance, impact on capital expenditure, impact on market share, impact on employees and other costs associated with an event.

Continuous development of scenarios and analysis

The TCFD recommendations acknowledge that, especially in the early stages of preparing climate statements, the scenarios themselves and the assessment of the impacts of those scenarios can be more qualitative and rely more on descriptive, written narratives, rather than a quantitative analysis. It is expected that over time, as Entities gain more practice in climate scenario analysis, learning from other disclosures and drawing from better quality data, that the disclosures will become more sophisticated, as will an Entity's ability to quantitively analyse the impact of scenarios on its activities.

The reduced liability of directors for non-complying climate statements in the Bill (which requires that the Entity and its directors knowingly fail to comply with applicable climate standards) compared to directors' liability for non-compliant financial statements appears to suggest that Government is aware of the need to facilitate a "learn by doing approach", which acknowledges that Entities need space to try in good faith to comply with applicable climate reporting standards, rather than penalising Entities that are still building the capability to comply with those standards.

What should be disclosed?

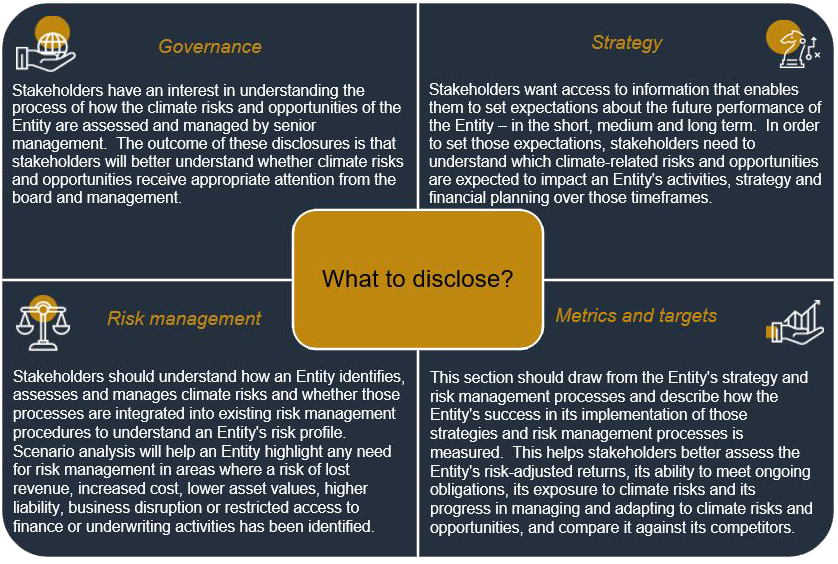

The TCFD recommendations focus on disclosing the implications of the climate scenarios on the four following core components of an Entity's business:

Where are we headed?

The RBNZ appears to have a strong interest in climate change, likely due to its core function of understanding, quantifying and managing major risks in the banking industry in New Zealand and the impact that climate change is expected to have in New Zealand's economy and financial system. Indeed, the RBNZ has expressed a keen interest in a number of regulatory initiatives related to climate change – for example by making submissions, releasing its own climate strategy and through its membership in international multilateral institutions dedicated to greening the financial system. The RBNZ has also regularly discussed climate change in its Financial Stability Reports and in November 2019 was appointed as the lead regulator on the Council of Financial Regulators in advancing climate risk workstreams, which is currently one of five core priority themes.

This suggests that some form of regulatory response to climate change, probably in the form of prudential supervision tools under its financial stability objective, seems likely at some future time.

Forward-looking scenario analysis is a tool used by the RBNZ in its function as a prudential regulator in undertaking financial stress tests on banks and insurers. The RBNZ announced in May 2021 that climate scenarios would form part of its 2021 financial stress tests on banks and insurers. The RBNZ has also indicated that it is actively increasing its capabilities in the climate change space.

It seems likely that, if the RBNZ chooses to add specific climate stress tests to its prudential toolbox, those stress tests would take the form of forward-looking scenario analysis. Accordingly, the introduction of the Bill could be of much interest to the RBNZ in its assessment of whether, and how, to introduce climate stress tests. It would seem that, if financial institutions are already required to undertake forward-looking scenario analysis in order to prepare climate statements, that those scenario analyses might be looked at or adapted by the RBNZ to assess an Entity's resilience to external climate events in its assessment of the prudential soundness of the Entities it regulates.

The RBNZ may draw on the work already done by the Bank of England and The Network for Greening the Financial System (NGFS) in this space – the NGFS has designed and released a set of hypothetical scenarios in June 2021, while the Bank of England has invited a number of UK financial institutions to take part in a pilot climate stress test that began in June 2021 and has set out its expectations relating to enhancing firms' approaches to managing climate-related financial risks in a Supervisory Statement and in a follow-up letter.

In addition to climate stress tests, the Climate Change Commission, a crown entity established by the Climate Change Response (Zero Carbon) Amendment Bill to provide expert advice to the government on mitigating and adapting to climate change and to monitor and review the government's progress towards its emissions reductions goals (Climate Commission) has recommended in its final report that the government implement policies that will incentivise the flow of finance to climate friendly activities and disincentivise the flow of finance to carbon intensive activities and create incentives to internalise environmental outputs. The exact shape of such policies and ensuing financial regulation is unclear (the government response to Climate Commissions' recommendations is due 31 December 2021 and any prudential regulation could be influenced by, but will ultimately be independent of, any such Government policy response) but it may take the form of:

- Capital relief for "green" or "sustainability linked" loans

- Shift in capital adequacy regulations towards long term risk

- Regulatory recognition to a new and broader idea of "value" and integration of Environmental, Social and Governance into core financial regulation, and

- Introduction of a stewardship code for financial institutions.

The disclosures contemplated by the Bill are intended to incentivise changes to an Entity's governance, strategy, risk management and metrics and targets to respond to climate risks and opportunities, and the Bank of England has already begun its work on setting out its expectations on what those changes should look like. With the RBNZ reinventing itself as a more conventional regulator and abandoning its traditional "hands-off" approach, the conditions are ripe for regulatory changes in this space to come.

Does the Bill signal the first step in climate related regulation or is this the end of the line?

The Bill may represent the most tangibly consequential piece of climate law in New Zealand's history. It has been established that climate risks are mispriced in almost every aspect of the financial system, and that such mispricing results in the misallocation of resources and exposes stakeholders to risks that are not sufficiently understood, non-diversifiable and affect almost all industries.

It is well accepted that, in addition to the physical risks of climate change, the mispricing of climate risk is a fundamental threat to the global financial system and, by extension, to the economic health of society. Indeed, the NZ Super Fund in its own TCFD climate disclosures released in October 2020 identified banking as one of five investments that presented the greatest physical climate risk to its fund. Investors and other stakeholders understand that, just as with any other risk, climate risks must be measured and disclosed in order to be understood – and only then can informed decisions be made relating to how to respond to those risks and how to efficiently allocate financial resources. They also understand that a standardised framework (such as what is contemplated by the Bill) is an efficient way to provide stakeholders with information that is relevant and comparable, and therefore can be better understood and can meaningfully influence decisions.

These disclosures are not only commercially valuable for external stakeholders. Engaging in the scenario analysis that underpins the disclosures can and should generate commercial value for any director or senior manager who intends for their Entity to continue to be operational, robust and hopefully thriving in 2030, 2050 and beyond. Engaging in this analysis will help directors and senior managers understand what risks the Entity faces and what opportunities can be capitalised on. Once those risks and opportunities are known and measured, they can be responded to through meaningful evaluation of an Entity's governance arrangements, strategy, risk management practices and metrics and targets, and it is likely that the Entity will be healthier and more resilient for it.

In our experience, most entities believe financial statements add genuine value to their business by identifying what the business has done in the past and what it has the capacity to do in the future. Climate statements have the potential to add that same value to Entities who engage meaningfully with the spirit of the process by using the climate statements to answer the following questions:

- What value is the Entity giving to its stakeholders right now?

- Does the Entity intend to continue adding value to stakeholders in 2030, 2050 and beyond?

- If so, what does that value look like? How does it look different to, and better than, the value the Entity is adding today?

- What changes can the Entity make to provide even greater value to stakeholders in 2030, 2050 and beyond than the value it is adding today?

- Are the governance, strategy, risk management and metrics and targets setting currently in place putting the Entity in the best position to deliver the desired value to stakeholders in 2030, 2050 and beyond?

- What can be done to improve those arrangements to ensure the Entity is in the best position to deliver the desired value to stakeholders in 2030,2050 and beyond?

There is a real possibility that climate change could revolutionise government policy in the next ten years, which will surely flow through to financial regulation in some form. It is still too soon to tell whether climate change will result in a revolution of financial regulation, but we think it is clear that it will form a substantial part of the ongoing evolution of financial regulation, and we expect to see more financial regulation to address climate change risk in the pipeline over the next five years.

This article was written by Scott Abel (partner), Lara Wood (special counsel), Simon Jensen (consultant) and Michelle Tustin (solicitor).