NZX has released a consultation paper and exposure draft of the proposed new NZX Listing Rules.

Key dates

- Submissions due: 8 June 2018

- Expected effective date of new Listing Rules: 1 January 2019

- Expected end of transition period: 1 July 2019

Overview

Key proposals include:

- Market structure:

- a single equity market, consolidating the NZAX and NXT into the Main Board (as well signalled by NZX)

- no differentiation between "Standard" or "Premium" issuers (dropping a proposal in NZX's initial consultation for a two-tier structure based on, say, capitalisation)

- Major transactions: Threshold for shareholder approval maintained at 50% of Average Market Capitalisation (dropping a proposal in NZX's initial consultation to reduce it to 25%) but adding a requirement for approval for transactions that would significantly change the scale of the issuer's business

- Share issues: Placement threshold reduced from 20% to 15% (as proposed in NZX's initial consultation)

- Half year reports: Removal of requirement for half year report. Instead, issuers will be required to publish preliminary financial statements for their half-year

- Continuous disclosure: Continuous disclosure obligations extended to constructive knowledge as well as actual knowledge. This is to enable NZX to consider the information that a reasonable director or senior manager ought to have known, when determining whether an issuer has complied with its continuous disclosure obligations. This aligns with the ASX. If this proposal is confirmed, it will require issuers to have processes in place for material information to be identified and brought to management's attention.

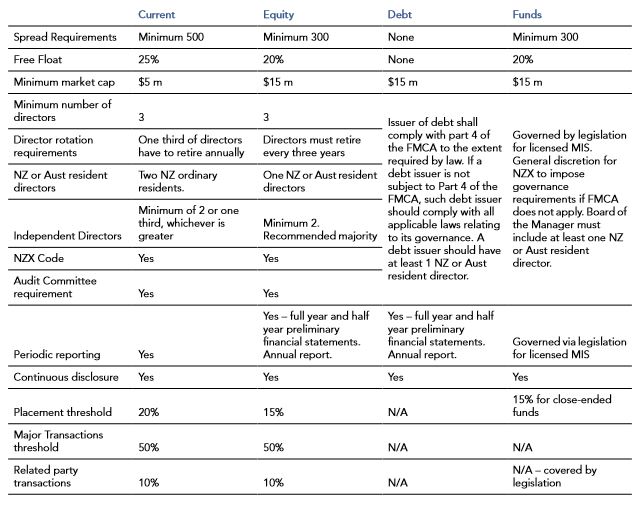

NZX's consultation paper also helpfully provides the following table summarising proposed settings:

NZX also proposes to simplify the Listing Rules. The exposure draft is 75 pages against the current 156 pages (excluding appendices).

Submissions

Buddle Findlay submitted on NZX's initial consultation and is pleased to see certain modifications to NZX's proposals in line with our submission (eg we opposed the reduction of the major transaction approval threshold from 50% to 25%). We will also be submitting on the exposure draft. Please contact us if you would like your views heard or help with a submission.