The Commerce Commission (Commission) has announced its final decision to introduce a new pricing standard which will significantly reduce interchange fees on the Mastercard and Visa credit and debit networks.

The Commission estimates that this new pricing standard will reduce interchange fees paid by New Zealand businesses by $100m, building on the $140m in annual reductions since the initial fee caps were introduced in 2022. The decision will have significant implications for all participants in the Visa and Mastercard networks, including issuers, acquirers, banks and other payment service providers.

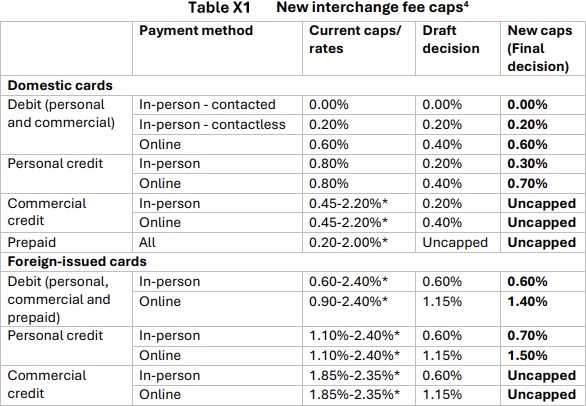

New interchange fee caps

An 'interchange fee' is paid by a merchant's bank or payment service provider (acquirer) to the bank or payment service provider that issued the card to the customer (issuer), in relation transactions through the Visa and Mastercard networks. The Commission monitors and regulates interchange fees under the Retail Payment System Act 2022, with a view to promote competition and efficiency for the benefit of merchants and consumers. Interchange fees in New Zealand vary across payment type, card type, merchant category and fixed vs. percentage rates.

The new pricing standard introduces the following revised caps, effective 1 December 2025 for domestic cards and 1 May 2026 for foreign-issued cards:

Source: Retail payment system (Page 7).

The decision also introduces a new anti-avoidance mechanism (through a mathematical ceiling on issuer compensation) which will limit payments or other benefits being provided to an issuer for the purposes of compensating it for the effect of interchange fee regulation.

The Commission has chosen not to regulate interchange fees for commercial credit cards at this stage, noting that further analysis is required to determine the appropriate fee cap level. However, the Commission expects that further regulation may be required if interchange fees in this category do not significantly reduce.

The Commission chose not to directly regulate surcharging, on the basis that surcharging is not universal among merchants and that surcharge rates are best targeted initially by reducing interchange fees which should flow on to lower merchant service fees.

The Commission also noted it will be closely monitoring whether savings are being passed on to merchants and consumers, through target reviews of merchant service fees (noting further regulation may be needed to ensure any surcharges are no more than cost), issuer scheme fees and rebates, and acquirer scheme fees.

Our view

While the interchange fee caps will most likely be seen as a positive step by merchants and consumers, time will tell whether, as some submitters argued, interchange fee caps may reduce innovation, stifle competition and prevent the entry of new competitors in the market.

Banks, payment service providers and other payment industry participants should consider the impact of the Commission's decision on their businesses, as well as likely future areas of additional regulation (such as in relation to surcharges) as anticipated by the Commission in its decision. Participants, including issuers and acquirers in particular, will also need to consider the impact of the new anti-avoidance methodology.

We also expect the Commission will be keenly interested in the development of the Reserve Bank of Australia's (RBA) Review of Merchant Card Payment Costs and Surcharging, in which the RBA proposes to go further than the Commission by banning surcharges, lowering the cap on interchange fees and increasing transparency of card payment costs. We will see in due course if the RBA's approach influences further regulatory efforts by the Commission, for example in relation to surcharges.

If you would like further detail on the application of interchange fees caps, or to discuss how this decision will impact your business, please get in touch with one of our experts.

This article was co-authored by Janet Liu (senior solicitor) and Andrew Suggate (senior associate).